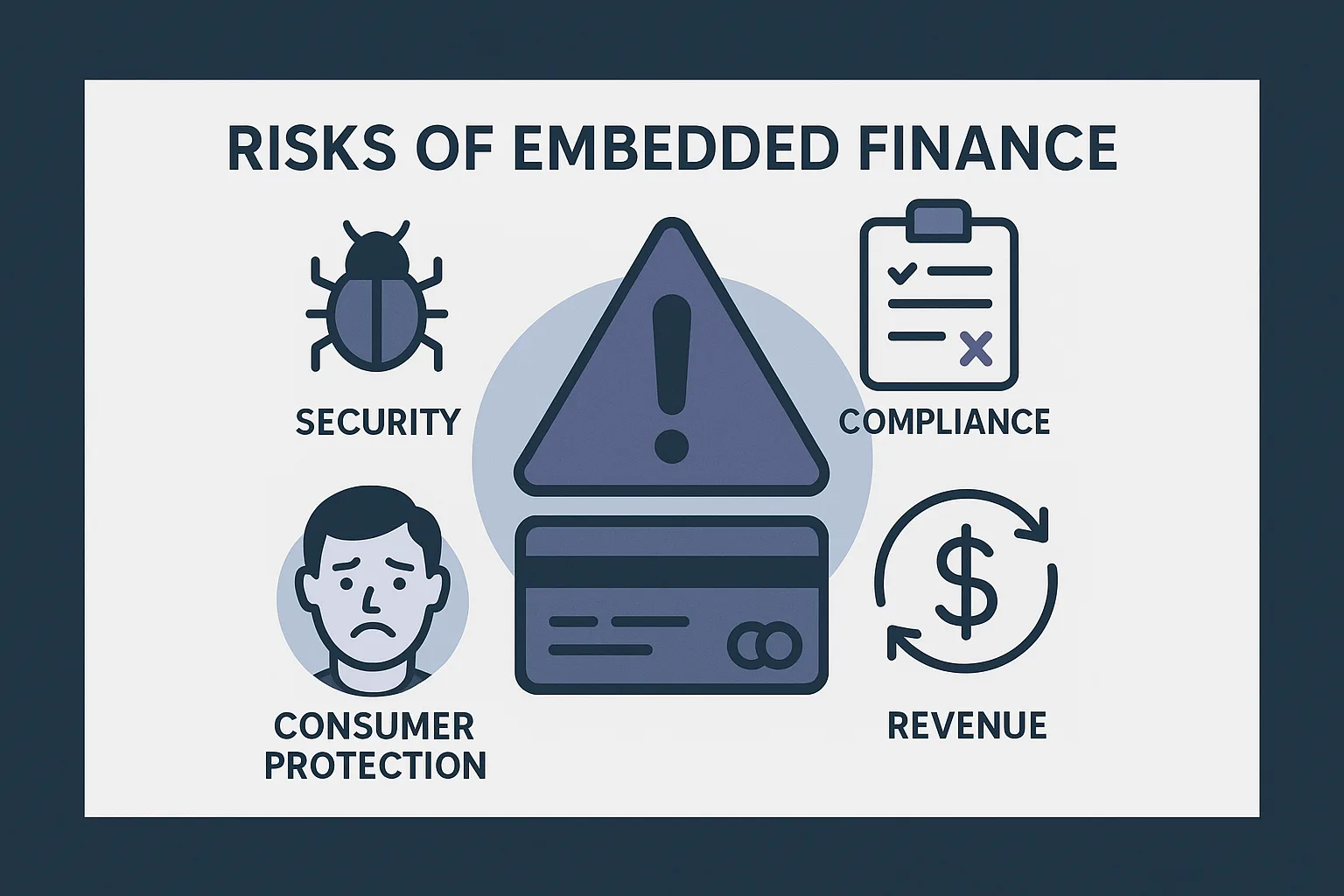

Embedded finance is transforming how individuals and businesses access financial services. It enables non-financial companies to offer services like payments, lending, insurance, or even banking directly within their platforms. Companies like e-commerce platforms, software firms, and marketplaces. This seamless integration provides users with a more convenient experience and offers companies new streams of revenue. However, the risks of embedded finance are often underestimated or misunderstood, especially by companies new to financial services.

Regulatory Uncertainty and Compliance Gaps

Many companies exploring embedded finance are not native to the financial sector. This unfamiliarity with financial regulation often leads to significant compliance oversights. A company may offer lending, insurance, or investment features without fully understanding the licensing requirements, data responsibilities, or consumer protection rules that apply.

The risks of embedded finance are magnified when regulatory responsibilities are shared across multiple entities. For example, your platform may depend on a partner bank or fintech to handle compliance, but regulators may still hold your company jointly accountable in the event of a breach. Additionally, regulatory frameworks are still evolving, with embedded finance often falling into grey areas.

Businesses must proactively seek legal advice, design strong compliance processes, and monitor shifting regulations to avoid fines, reputational damage, or forced product shutdowns.

Data Security and Privacy Concerns

Embedded finance operates on large volumes of sensitive customer data. Platforms collect and transmit personal identification, bank account numbers, transaction histories, and more. Often via third-party APIs. Each data exchange introduces new potential vulnerabilities, especially when multiple external providers are involved.

A key concern among the risks of embedded finance is the heightened exposure to data breaches and misuse. One weak link can jeopardise customer data. be it an unsecured API, poor encryption, or a compromised vendor. In addition to damaging trust, this can trigger regulatory investigations and lawsuits under GDPR, CCPA, or similar laws. To mitigate this, businesses must implement robust data governance practices, including encryption standards, penetration testing, incident response plans, and vendor security reviews.

Operational Complexity and Third-Party Risk

An embedded finance product often relies on a web of partners: a front-end platform, a fintech provider, a banking-as-a-service (BaaS) layer, and possibly a regulatory or KYC provider. While this structure allows for modular service design, it also increases operational complexity and fragility. If one party experiences downtime, customer onboarding fails, or transaction processing stalls.

This interconnected setup is one of the less visible but serious risks of embedded finance. A service outage, delayed transaction, or billing error by a partner can directly impact your customers. Even if your platform is technically not at fault. Moreover, you may be held responsible in the customer’s eyes. Clear contracts, operational playbooks, backup systems, and contingency planning are essential for minimising this risk.

Customer Confusion and Brand Liability

Customers engaging with embedded financial services often assume they are dealing solely with your brand. They may not recognise that a loan, insurance policy, or payment service is provided by a third party. As a result, when something goes wrong they will likely turn to your company for answers and accountability. For instance a denied transaction or delayed refund.

This brand exposure is one of the more reputational risks of embedded finance. Confused users may leave negative reviews, initiate chargebacks, or stop using your product altogether. Even when your role is limited, your brand is on the front line. To manage this, businesses must clearly disclose partnerships, set user expectations, and establish a customer support system trained to handle financial queries. Proactive communication is critical to protect your brand equity.

Financial Exposure and Credit Risk

Companies that offer lending, instalment payments, or revenue-based financing directly through their platforms may be exposed to credit and fraud risks. Even when a licensed partner underwrites loans, your company may share the economic impact of defaults, especially under profit-sharing or revenue-based models. Fraudulent actors may also exploit weak verification processes or loopholes in multi-party systems.

Understanding the financial risks of embedded finance is crucial before entering high-stakes areas like credit or deferred payments. Poor underwriting decisions, lax fraud controls, or mismatched incentive structures can quickly erode profitability. To reduce this exposure, businesses should co-design credit policies, invest in fraud detection systems, and negotiate risk-sharing terms carefully with financial partners.

Conclusion: A Strategic Approach is Essential

The risks of embedded finance are real, multifaceted, and often underestimated. While the potential rewards are compelling, companies must think beyond the user interface and approach embedded finance like a regulated institution. This means building robust legal, compliance, and security foundations, maintaining strong oversight of third-party partners, and clearly defining roles and responsibilities across the service chain.

As more companies look to embed financial features, those that prepare for the risks of embedded finance will have a significant advantage. Risk-aware firms can deliver trusted, seamless financial experiences that unlock value for users while protecting the brand. Ignoring the hidden pitfalls, however, can lead to costly consequences.